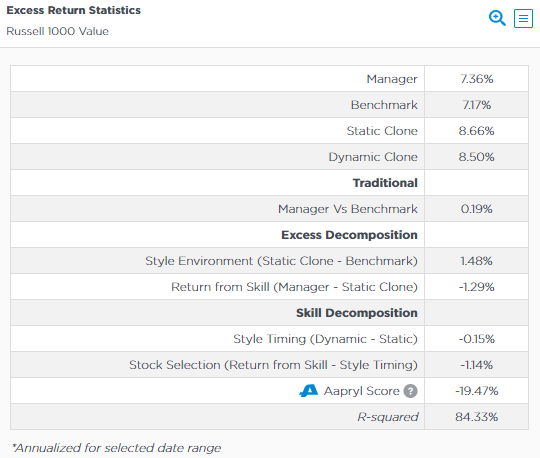

The table shows a breakdown of the performance of the manager against various metrics as well as a decomposition of the excess returns to help users understand how a manager derived its performance and how much was from skill. The table measures the manager’s return against the benchmark, static clone and dynamic clone. Additionally, the Style Timing calculation provides the return derived from style changes over time to the portfolio. The Stock Selection calculation provides the return derived from pure security selection. The table also shows Aapryl’s proprietary Aapryl Score metric as well as the R Squared of the regression used in the calculations.