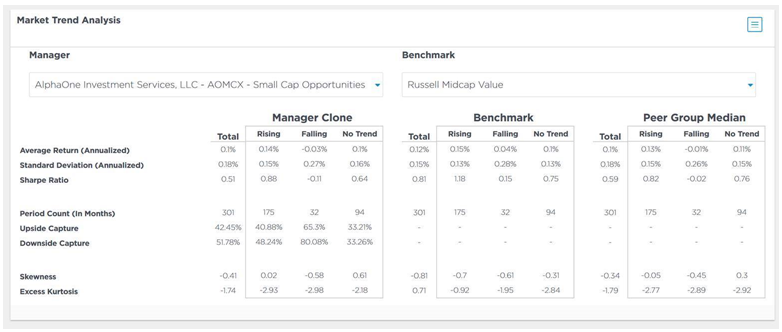

The chart shows how a manager’s clone portfolio has historically performed in different market environments. Using the designated benchmark as the proxy, the market’s performance is separated into three distinct regimes: upward trending or rising, downward trending or falling and markets in which no trend could be determined. The performance of a manager’s clone portfolio is then calculated in each market regime. This provides users with an expectation of how a manager can be expected to perform in various market environments. The chart also displays the returns of the benchmark and the manager’s peer group average for comparative purposes.

The bottom section of the chart shows the up market and down market capture ratios. This is the percentage of the market return which is achieved during up and down markets respectively. For example, a caputure ratio over 100% would indicate that a manager has achieved higher gains than the market during times in which the market was up, while a ratio below 100% would indicate that the manager did not achieve the full market return. Similarly, a down market capture of over 100% would indicate that the manager achieved losses in excess of the market in down markets; while a ratio below 100% would indicate that the manager did not lose as much as the market in down periods. Therefore, the optimal ratios for a manager are an up market capture ratio above 100% and a down market capture below 100%.