Overview

With over 25,000 investment managers registered in various databases, investors and/or allocators face a surfeit of investment manager choices. However, even with a plethora of manager data, the old pattern of hiring investment managers that appear to be at the top of their game only to revert to average, or even poor performance, still persists.

Acknowledging this lack of persistence in performance analysis, most investors supplement their quantitative work with qualitative and security based portfolio analysis. The problem is that this supplemental analysis is utilized after the quantitative screens because the primary challenge at the front end of a search process is to reduce a large number of manager choices to a smaller, more manageable number of managers on which an investor can do a deep dive qualitative assessment.

Aapryl’s Skill Screening Module allows allocators and investors to quickly hone in on managers with a high probability of exceeding their respective peer groups and benchmarks. Performance is not persistent or properly calculated, but manager skill is. Our proprietary forecasting methodology looks beyond explaining past performance to identify a more persistent measure of manager skill. The methodology is designed to isolate and analyze the active decisions of the manager over time. Our process disaggregates manager decision making from a passive exposure to well known factors.

How it works

![]()

START SKILL SCREENING

With Skill Screening, Aapryl will identify which products within a Universe possess the best likelihood to outperform its peers.

![]()

SELECT A UNIVERSE

Select a Universe to rank its constituents.

![]()

ANALYZE SKILL SCREENING RESULTS

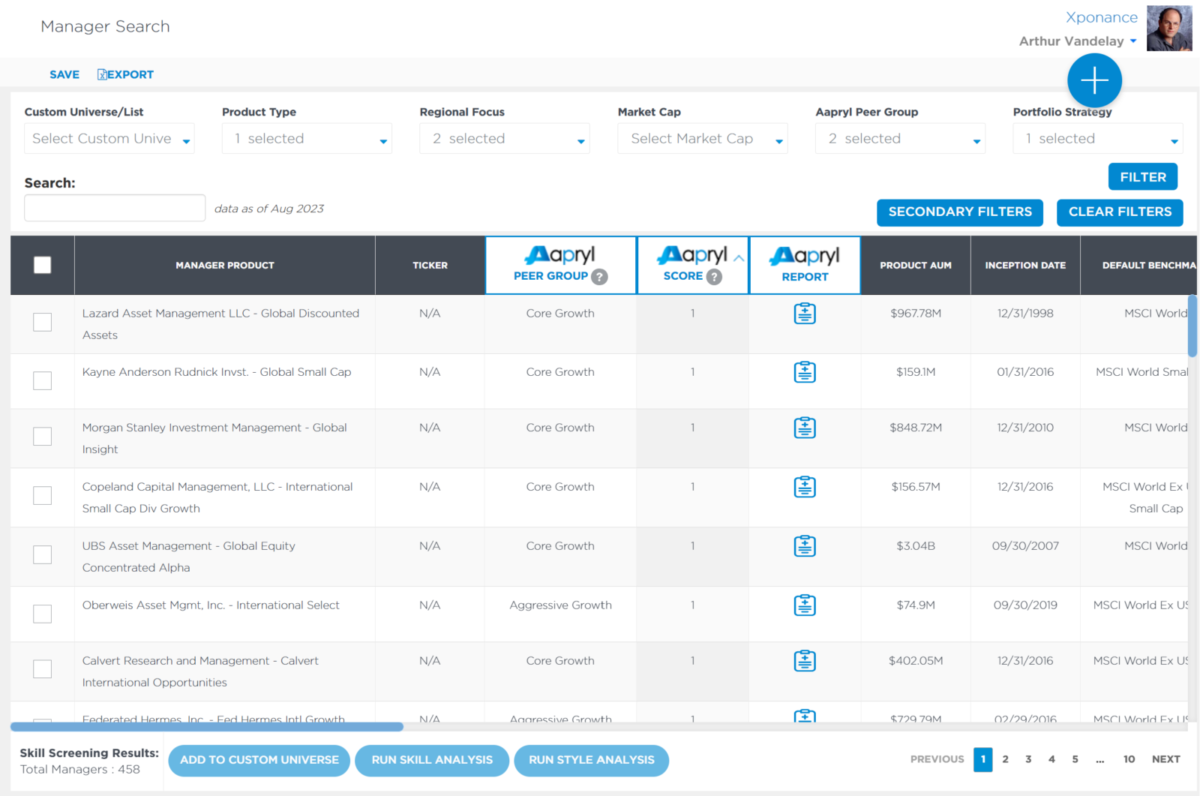

View a ranked list of Managers and filter in/out specific criteria and attributes.

Videos

No items

White Papers

Purpose: Aapryl’s Skill Screening module analyzes a manager’s track record to help users choose the best managers from a universe of managers. The module combines the use of the proprietary analytics generated by the Skill Screening Engine with industry standard statistical techniques to allow users to identify managers based on their skill. The module overcomes a major flaw in many of the screening tools available by incorporating calculating a predicted excess return over a manager’s style during the screening process.

Glossary of Terms:

- Predicted Style Adjusted Excess Return- A proprietary statistic calculated in the Skill Screening Engine that predicts a manager’s 3-year excess return over its style.

- Universe- A grouping of managers or a peer group from either a published database or a custom calculation that users can use to screen and rank managers.

Description of Methodology: Aapryl’s Skill Screening Module allows users to create and save custom peer groups. Peer groups can be created from published databases or from clusters that were created in the clustering module. Once created, the users can screen the universe to conduct manager searches and see rankings of the universe. Peer groups can be screened by static data provided by databases including AUM, Expense Ratio, Domicile and more. A key feature of the module is that managers in a universe are ranked by Aapryl’s proprietary Predicted Style Adjusted Excess Return.

Information Provided: Aapryl is able to use this information to provide users with charts and graphs that contain an abundance of useful information which includes the following:

- Custom Peer Groups- Users can create custom peer groups to see managers in the context of their peers.

- Manager Rankings- Reports can be generated showing the rankings of managers in a peer group by various criteria including Aapryl’s proprietary Predicted Style Adjust Excess Return.

- Manager Screening- Users can customize their searches by screening managers from a peer group. Reports are available showing all of the managers in the adjusted universes.

Additional Information

For more information on the methodology behind Aapryl’s Skill Screening, please review the following material(s):

Predictive Investment Manager Ranking System

With over ten thousand mutual funds and separately managed accounts to choose from, investment allocators have their work cut out for them. They need to choose a few managers to meet their investment needs from an almost…Read More